Many individual tax payers have been receiving a notice from IT department under section 143(1) of the Income Tax Act owing to the inconsistency between salary income filed in return and that as per Form 26AS.

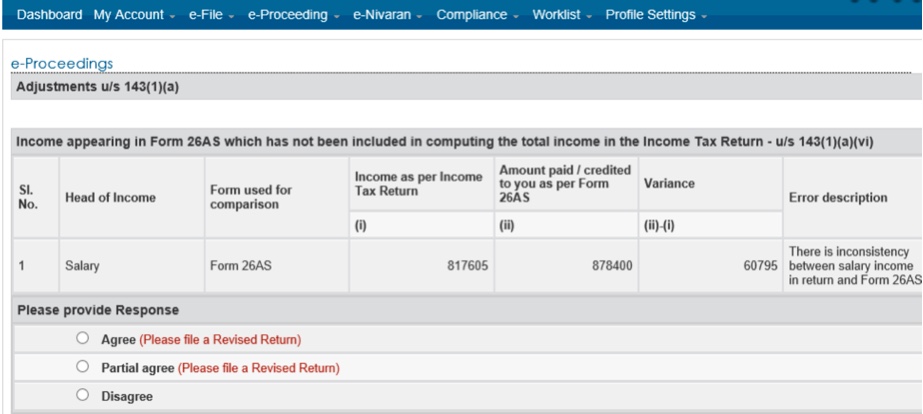

The notice appears something like this:

To put this in simple words, there is basically a difference between the salary income reflecting in Form 26AS (the advance tax & TDS summary auto generated by the tax department) and that reported in income tax return filed by the taxpayer.

This is because the data picked up by the department while processing 143(1) is from a different source as compared to that filed by the employer through the e-TDS return. Please note that the information submitted by the employer and the employee would both be correct – let us look at the example below

Let us consider an employee X having gross salary of Rs. 8,78,400 and salary after deductions under section 10 (that is HRA exemption, conveyance allowance, LTA, etc) is Rs. 8,17,605.

The figure that appears in Form 26AS will be Rs. 8,78,400 but that reported in ITR is only Rs. 8,17,605. This difference is inquired into by the income tax department by sending the notice u/s 143(1).

Worry not! The inconsistency can be rectified by submitting a response on the E Filing portal. Please follow the steps below

Click on the E Proceeding tab once you login to the E Filing portal. The following is displayed:

Click on “Adjustment u/s 143(1)(a)”. That will take you to the following screen:

Once you click Submit, the following screen will be displayed

If you disagree with the notice then select “Disagree”

We then have to provide reasons for difference between the salary amounts as per Form 26AS and that disclosed in the income tax return. Usually the difference will arise only because of exemptions claimed under section 10 and medical expenditure met by the employer on behalf of employee not forming part of salary.

The appropriate provision under section 10 can be selected from the drop-down (see image below). In case exemption is claimed under multiple heads under this section, like HRA, conveyance, etc ,more line items can be added.

Finally, the total of all amounts entered (Total Variance explained) should match to the amount of variance indicated in the notice and unexplained variance displayed in point 7 of Dynamic Reconciliation statement at the bottom of the table should be zero

Once finished, the table looks something like this:

Click Submit to complete.

In the above table, if you agree with the demand raised, then the next step would be to revise the return of income.

If you have any further questions on the notice u/s 143(1), please do not hesitate to reach out to us on pavan@bclindia.in. We would be glad to be of your help